KPPIP Achievement- SEMESTER 2 2017 (Juli – Desember 2017)

A. Project Preparation Support

Outline Business Case (OBC) for Bitung International Hub Port (PHI)

The OBC for Bitung PHI formulates the synchronization and integration of Bitung PHI port development with the existing port in Bitung, Bitung SEZ, and Lembeh Island, and provides recommendations on regional development, alternative institutional patterns and the most optimum funding scheme. KPPIP facilitated the preparation of Terms of Reference (TOR) for OBC Consultant Procurement by inviting inputs from stakeholders, particularly the Ministry of Transportation.

In April 2017, KPPIP conducted a tender for OBC Bitung PHI consultant. This tender process was completed in May 2017 with the consortium of PT Mott MacDonald Indonesia, PT Deloitte Konsultan Indonesia and PT Hana ah Ponggawa & Partners selected as successful bidders. OBC Bitung PHI preparation was commenced with kick-off meeting on 6 June 2017. In the implementation, KPPIP involved stakeholders at every stage by organizing two Coordinating Meetings (25 July 2017 and 18 October 2017), two Focus Group Discussions (1 August 2017 and 8 November 2017), and two Market Consultations (28 November 2017 and 6 December 2017).

This OBC Bitung PHI preparation produced preliminary analysis of the trading and navigation conditions and trends in Bitung and the surroundings, alternative Bitung PHI development from a technical perspective. It also provided financial and economic assessment, legal assessment and regulatory assessment of the relevant regulations, and of Bitung PHI development structure. Analysis to trading and navigation conditions and trends in Bitung and the surroundings showed the need for improving the feasibility of Bitung International Hub Port from a throughput aspect. This port is expected to serve throughput of some 21.4 tons per annum in 2050. The rst stage of Bitung SEZ development of 534 hectares will provide additional throughput to Bitung International Hub Port of 2.4 million tons per annum in 2050. However, further capacity expansion to 2,000 ha must also be appropriately justified. This expansion will provide additional throughput of 11.9 million tons per annum.

It is also evident that to promote the status of Bitung port as an International Hub, rmer Government policy is needed to divert shipping traffic to Bitung and assign Bitung as a Hub for the Eastern Regions of Indonesia. These additional throughputs can be generated from such diversion, i.e. to range from 21.1 to 45.9 million tons per annum in 2050 dependent on catchment areas. However, in view of its uniqueness and possible unexpected consequences, further analysis is deemed necessary to validate this Eastern Region Hub scenario.

Analysis of alternative developments from a technical perspective indicates the need to satisfy the following infrastructure matrix for the various facilities that follow:

- Container: ~ 1,500 to 2,000 TEU/Lineal Meter Berth Line or -+ 30,000 TEU/hectare container terminal area

- Liquid Bulk: 3 to 5 Mtpa/berth and tank farm with cap. 5 to 20 storage turnovers per annum (dependent on products/buyers)

- Dry bulk: 10 to 25 Mtpa/berth and stockyard with capacity to store throughout 5-25% dependent on the product

- Break bulk and general cargo: 2 to 5 Mtpa/berth and supported with capacity ~2 ha dock side storage per Mtpa.

Technical analysis also identified the need for integration of land transportation development from and to Sam Ratulangi airport, yover construction connecting Bitung port to the port in KEK Bitung, Tanjung Merah, Manado- Bitung railway project development acceleration, and inter-city railway network development especially on high priority routes including Kema-Belang-Tutuyan- Molibagu-Gorontalo for connection with Manado-Bitung railway network design.

Project nancial feasibility analysis has been made for two development scenario alternatives selected for sensitivity analysis:

- Master Developer Model, in which investors just play a role as Port Developer

- Bundled Developer and Operator, in which investors will be both Port Developer and Operator.

The results of analysis indicate that under the Master Developer model (investors only play role as developer) can generate profits of USD1.89 billion (Net Present Value after tax) or 11.4% (real-IRR after tax) during the concession period until 2050.

However, if investors are also operators, in the Developer and Operator model, the same project will generate a rate of return at USD259 million (Net Present Value after tax) or 4.6% (real-IRR after tax) during concession period until 2050. According to the financial assessment, such a rate of return means that the project can only be executed marginally. In this case the project would need substantial financial support from the Government, especially in the form of land acquisition for the port, KEK and over y road. If the Developer and Operator model is to be adopted, then the existing tariff setting for cargo service in Bitung will need to be reviewed to make the project more financially feasible for the operators.

Economic impact analysis of Bitung International Hub Port (PHI), including Cost Benefit Analysis, shows that the development of this project is able to bring significant economic impacts. Under the Master Developer scenario option, the economic costs arising from this project are USD2.67 billion with economic profits of USD2.68 billion. Meanwhile, in bundling the port developer and operation scenario options, the economic costs are USD2.55 billion with economic profits of USD2.67 billion. Economic stimulus to port development may also generate broader economic impacts. For example, it is very likely that the Special Economic Zone will experience significant improvements once the port is developed. Port development can also stimulate regional economic growth.

- Bitung Special Economic Zone (SEZ) Development:

a. Land acquisition

b. Land occupation by local communities

c. Time required by Bitung SEZ to be ready to?operate

d. Bitung SEZ development plan for 2,000 ha

e. Light Railway Track development plan - Bitung Port Development Plan

- Transhipment Ban

- Consolidation of Goods Transportation or Navigation Route to Eastern Regions of Indonesia via Port of Bitung

- The absence of Technical Criteria for International Hub Port

- Bureaucracy established by the Government of Philippines for Cement Import

- Diminishing coconut supplies in North Sulawesi

- Security – defense aspects of Bitung International Hub Port Development.

With regard to development stages, Bitung PHI will accommodate the existing Port of Bitung Development Master Plan prepared by PT Pelindo IV.

Patimban Port Intermoda Master Plan

To implement the cross-sectoral integrated Patimban Port development plan, KPPIP procured consulting services for the preparation of a highway and railway infrastructure master plan to support intermoda integration of Port of Patimban. A consortium consisting of PT Worley Parsons Indonesia and PT KPMG Indonesia was selected as Consulting Team to prepare such a Master Plan.

The preparation of the master plan was initiated with a kick-off meeting on 14 June 2017. In subsequent stages, KPPIP involved stakeholders by organizing two coordinating meetings (on 28 August 2017 and 5 December 2017), and two Focus Group Discussions (18 September 2017 and 2 November 2017).

Based on the review, the Master Plan considered 3 options of separate integrated routes. The master plan includes Access Road to the Port connecting Pantura Corridor (National Road Network along North Coast of Java Island) and the existing Port of Patimban and calculates the estimated journey time for logistic traffics in various alternative accesses. The Master Plan also provides economic and financial evaluation. IRR(Internal Rate of Return) and NPV (Net Present Value) are separately evaluated for individual options. The access road to the port and the access road to railway will be financed by the Government utilising JICA loans. Toll Road construction will be financed under a PPP scheme. The Master Plan provides funding structure analysis, project IRR, equity and sensitivity analysis describing potential impacts to the nancial/economic performance of project in case of changes to several project parameters.

The Master Plan also presents the estimated Capital Expenditure (CAPEX) and Operation and Maintenance Expenditure (OPEX) for several alternatives. Furthermore, the Master Plan proposes a short schedule for Project Development, i.e. from the use of Access Road to the Port via toll road to the completion of railway access. Risks, advantages and disadvantages have been summarized in this Master Plan for every transportation access point to the port and the recommended integrated intermoda system.

The master plan recommends the integration of intermoda infrastructure development plan covering national roads, toll roads and railways, while ensuring spatial suitability for land use planning, demand on the port and eficiency of journey time from Port of Tanjung Priok and industrial estates in Cikarang and Karawang to Port of Patimban and vice versa, and the synergy with the existing transportation infrastructure. Based on preliminary review, the recommended intermoda access with the best eficiency and effectiveness in terms of technical aspects, spatial planning and environment and finance is Option A, i.e.:

- Road Access to the Port connected from Pantura corridor subject to review of DG Roads and Bridges (Bina Marga), the Ministry of Public Works and Public Housing;

- Toll Road with modification to Subang Interchange; and

- Railway tracks in parallel with the toll road from a starting point at Pagaden Baru Station.

The preparation of the Master Plan was accomplished with Final Presentation to Internal KPPIP on 21 December 2017, from which a number of inputs recommended during the presentation will be included in Final Report.

Outline Business Case (OBC) for Yogyakarta – Bawen Toll Road

Yogyakarta – Bawen Toll Road has been a Priority Project since 2017. The Feasibility Study for this project was accomplished in 2009. However, this feasibility study has been considered no longer relevant and data update is therefore necessary. In light of that, KPPIP facilitated the preparation of an Outline Business Case (OBC) to produce OBC documents, which reflect the actual conditions and in compliance with OBC standards established by the Government under Regulation of the Minister of Bappenas No. 4 of 2015 concerning Procedure for the Implementation of Public – Private Partnership (PPP) in Infrastructure Development. For this purpose, KPPIP has tendered consultant procurement for OBC preparation, with PT Price Waterhouse Coopers Indonesia Advisory determined as?the successful bidder. The OBC was completed in December 2017.

During OBC preparation, KPPIP organized intensive coordination with various stakeholders at central level as well as at regional level. Some meetings held included:

- Coordinating Meeting of OBC progress to report the latest development of OBC preparation to the Ministry of Public Works and Public Housing Coordinating Meeting with Central Java Province Government and DIY Government

- Meeting with Sri Sultan Hamengkubuwono X in the capacity of the Governor of DI Yogyakarta

- Meeting with Magelang Regent

- Meeting with Temanggung Regent

The most significant stage in OBC preparation for Yogyakarta – Bawen Toll Road concerned its route design. Through in-depth analysis and a number of meetings some options for Yogyakarta – Bawen routes were proposed as follows:

- Two options in Central Java areas:

Option 1: go through the Eastern side of Magelang Regency

b. Option 2: go through the Western side of Magelang Regency - Three options recommended for DI Yogyakata areas:

Option A: at grade

b. Option B: elevated crossing Mataram Irrigation ?Ditch (Selokan Mataram)

c. Option C: the end of toll road in Yogyakarta ?connected to the planned outer ring road

Based on analysis and evaluation method to technical, environmental and cost parameters, Option 1 was selected as the best alternative (ranking 1). In terms of cost parameters, Option B was found to be the option requiring higher capital cost. However, in view of inputs received from the local government and discussion with stakeholders, Option 1B was regarded as the most optimum route from a stakeholder perspective and thereby selected as the most appropriate route. This preferred route will avoid big issues of land acquisition and social impacts during project implementation, particularly in D.I. Yogyakarta province.

From a commercial perspective, the OBC analyzed the financial feasibility indications of project using assumptions and data, which were mostly collected from surveys and analysis as parts of this review. Financial feasibility analysis in OBC was undertaken for several business model scenarios, namely, a user based payment scenario, in which the concessionaires will receive investment return based on revenue earned from toll road users, and an Availability Payment scenario in which the investment return will be based on the payment by the Government for the availability of infrastructure services operated by concessionaires. However, the obtained values were derived from data available during OBC preparation and therefore subject to change in case of revisions to the main assumptions applied.

Another aspect reviewed in this OBC included Value for Money (“VfM”) analysis by comparing project development under a conventional Goods/Service Procurement Contract (KPBJ) scheme to a PPP scheme. The analysis indicated that procurement with a PPP scheme has potential to provide savings for the Government of around IDR 696 billion or 14.64% of Project value than if implemented with a goods/services procurement contract scenario by the Ministry of Public Works and Public Housing with State Budget. While a PPP scheme is more complicated in its procurement process than Goods/Service Procurement contract (KPBJ) scheme, the former has more advantages and will produce a better Project with lower risks to the Government.

From the economic feasibility aspects of the Project, OBC also provided social-economic cost-benefit analysis. This analysis indicates that Yogyakarta – Bawen Toll Road Project will produce higher benefits than its cost. According to Economic Benefit and Social Cost Analysis, Yogyakarta – Bawen Toll Road is expected to produce the following benefits:

- Generate economic benefits worth IDR 40 trillion (at present value) during 40 years of the agreement term.

- Provide positive economic rate of return with net present value in amount of IDR 1 trillion and EIRR 21. This shows that this investment is economically justi ed with a benefit-cost ratio of 4.5.

Apart from technical, economic and commercial aspects, the OBC also dealt with analysis from legal and institutional perspectives. The legal analysis aimed to:

- Ensure that Project had been processed according to the applicable laws and regulations from the following aspects:

(a) Business body establishment;

(b) Capital investment;

(c) Business competition;

(d) Environment;

(e) Occupational safety;

(f) Land acquisition;

(g) PPP financing scheme, including revenue ?financing mechanism;

(h) PPP licenses;

(i) Taxes; and

(j) Other related regulations. - Identify the legal risks and the associated mitigation strategies;

- Review possible regulatory revisions;

- Identify types of permits/approvals required; and

- Prepare plans and schedules to comply with ?regulatory and legal requirements.

The institutional analysis of the Project was carried out to:

- Ascertain the authorities of the Contracting Agency in Project implementation;

- Map the stakeholders by assessing the roles and responsibilities of agencies engaged in Project implementation;

- Set the roles and responsibilities of PPP Team on preliminary pre-feasibility study review, nal pre- feasibility study review and establish the reporting system of the PPP Team to the Contracting Agency;

- Set and prepare regulatory – institutional instruments; and

- Establish the terms of reference for decision making.

On 3 October 2017, a discussion was held to select Yogyakarta – Bawen Toll Road Route as part of OBC preparation. While taking various technical and social aspects into account, the discussion, which was organized by Toll Road Regulatory Body (BPJT), set option 1 (Central Java) and Option B (D.I. Yogyakarta) as Yogyakarta – Bawen Toll Road routes.

After obtaining approval for the proposed routes from stakeholders, the Directorate General of Roads and Bridges (Bina Marga) prepared letters for submission to the Governor of Central Java Province and the Governor of D.I. Yogyakarta Province asking them to issue letters confirming such locations as the routes of Yogyakarta – Bawen toll road.

Environmental Impact Assessment (EIA) for Yogyakarta – Bawen Toll Road

An Environmental Impact Assessment (EIA) for Yogyakarta – Bawen Toll Road has been prepared alongside with OBC preparation for Yogyakarta – Bawen Toll Road. KPPIP prepared a tender for the selection of EIA Preparation Consultants with PT Karsa Buana Lestari determined as the successful bidder. They were tasked to prepare an EIA to facilitate the issuance of Environmental Permit of the Ministry of Environment within 5 months as from 1 August 2017.

During OBC preparation, KPPIP built intensive coordination with stakeholders at both central and regional level. On 14 August 2017, KPPIP convened a Kick-Off Meeting to start the implementation of the EIA Study for Yogyakarta – Bawen Toll Road with attendance of the related stakeholders. During the Kick-Off Meeting, the participants agreed on the need for accelerating the toll road routes decision that enabled EIA Consultants to proceed with socialization and survey activities as soon as possible.

Yogyakarta – Bawen Toll Road EIA was prepared simultaneously with OBC preparation of the same toll road. To prepare the EIA, the selected routes must be confirmed and this task was within the scope of OBC works. In this case, KPPIP put much effort into synchronizing information and progress of these two studies. Information synchronization is important to ascertain that EIA preparation will not be disrupted with inconsistent information used as basis in EIA and OBC preparation for Yogyakarta – Bawen Toll Road.

Since stake holders had yet to confirm the selected toll road routes and it has been behind the original schedule, EIA preparation was just to reach the stage of Terms of Reference (TOR) preparation for ANDAL (Environmental Impact Analysis) and Environmental Permit processing, which was expected to be issued in April 2018.

Real Demand Survey and Capital Expenditure Calculation for West Semarang Water Supply Project (SPAM)

West Semarang Water Supply Project is a Priority Project under the PPP scheme. This drinking water supply project in West Semarang was initiated in 2012 with a real demand survey prepared by JICA, also in 2012. For the OBC, a nal feasibility study was prepared by PT Indonesia Infrastructure Finance in 2014 and updated in 2017.

Upon evaluation to such studies, KPPIP emphasised the need for data update with a real demand survey to get the most up-to-date and accurate illustration on clean water needs and demands of areas to be served by this PPP-Based West Semarang Water Supply Project. The updated data from real demand survey should be adopted as reference in Final Business Case (FBC) preparation. This work will be tendered to prospective bidders. Alongside the real demand survey, KPPIP also initiated a piping capital expenditure (CAPEX) calculation to estimate investments required for pipe network development that must be provided by the prospective investors. PT SMEC Denka Indonesia was selected to perform this study.

The Kick-Off Meeting of real demand survey study was held on 4 September 2017 and continued with data collection process by PT SMEC Denka under coordination with Semarang Municipality Government and PDAM Tirta Moda in the capacity of Contracting Agency for West Semarang SPAM Project. On 27 November 2017, a focus group discussion on the results of real demand survey and piping capex calculation was organized involving the Ministry of Finance, the Ministry of Public Works and Public Housing, Semarang Municipality Government, PDAM Kota Semarang and PT SMI.

A real demand survey and a piping CAPEX study were completed in November 2017 and used as inputs by the Ministry of Finance and PT SMI for transaction preparation process of West Semarang SPAM Project.

The final results and conclusions of the study presented by KPPIP to stakeholders of West Semarang SPAM Project are as follows:

- At present, clean water service level in West Semarang service areas, i.e. Semarang Barat District, Ngaliyan District, and Tugu District is only 44.26%. This clean water service to the residents of West Semarang areas must be enhanced. According to the target set by the Government in Sustainable Development Goals (SDGs) at 100% by 2019, there is still a need to increase the existing level by 56%.

- The real demand survey indicates a service target of 86%. To pursue this target, breakthroughs of intensive socialization and encouragement for local households to install new connections by PDAM and regulations banning the consumption of water extracted from deep wells to attract them to register as PDAM customers will be necessary;

- While West Semarang Water Supply System is feasible for the construction of a Water Treatment Plant with capacity of 1,000 l/sec, however, a special strategy to absorb such capacity will be important;

- The preferred pipes for transmission mains are the combination of steel pipes, High Density Polyethelene (HDPE) and Polyvinyl Chloride (PVC). For distribution mains, similar to transmission mains, combined pipes are preferred, i.e. steel pipes, HDPE and PVC; and

Total investments necessary for pipe network construction that have been updated by consultants are estimated as IDR357.8 billion with transmission mains made of steel pipes and distribution mains of HDPE pipes, IDR297.3 billion for transmission and distribution mains consisting of HDPE pipes, and IDR202.9 billion for transmission and distribution mains made of PVC pipes.

Financial Models for Waste to Energy (PLTSa) Project

Waste to Energy Project is a Priority Project selected in 2017. The local governments being Contracting Agencies for this Waste to Energy Project admitted that their local budgets allocation for processing fees are very limited. For example, Tangerang Municipality stated that their maximum budget for processing fees was IDR100,000/ton only. Given that, Waste to Energy Project is intended to adopt a PPP scheme.

To prepare its OBC, financial modelling must be made to identify the tipping fee value. To get this tipping fee value, KPPIP with support of a Forecast Financial Modelling Consultant has prepared financial and economic modelling for Waste to Energy Tangerang Project for capacity building purpose. This Forecast Financial Modelling provides a worksheet template to KPPIP that can be used to calculate the value of the required tipping fee.

Financial calculation has been made using technical and financial assumptions taken from reviews by a multilateral agency (International Financial Cooperation, the Ministry of Environment, Japan) for Waste to Energy Tangerang and Denpasar Projects.

According to financial review by KPPIP under assumptions of garbage volume 1,000/ton/day with calorific value 1,300 kcal/kg, the generated power 16 (MW) gross), electricity tariff at US$18.77 cent/kWh (IDR 2,533.95/kWh), loan interest 4.6%, the IRR of Project will be 8.1 – 9.3% and positive NPV subject to conditions:

- Capital Expenditure US$90 million will require tipping fee IDR200,000/ton

- Capital Expenditure $116 million will require tipping fee IDR375,000/ton

KPPIP has communicated this tipping fee calculation to stakeholders at central level and to the local governments concerned. Regulation on tipping fee is currently being drafted by the Ministry of Home Affairs.

B. Determining Project Funding Scheme

Kereta Api Ekspres Bandara Internasion Soekarno – Hatta International Airport Express Rail Link al Soekarno-Hatta

Airport Express Rail Link Project is an alternative transportation mode to Soekarno – Hatta International Airport (SHIA), which includes a dedicated SHIA express rail link. In 2013, the Minister of Transportation con rmed the route for this dedicated SHIA express rail link via Halim – Manggarai – Dukuh Atas – Tanah Abang – Pluit – SHIA. However, in 2015 the routes were planned to revise via Gambir.

While the rail link routes were confirmed, no funding scheme had been established for this Project. In 2014, the preparation of its pre-feasibility study was completed by PT SMI and approved by Director General of Railways, the Ministry of Transportation in September 2014. The recommended project funding scheme was a PPP scheme. In October 2015, the Minister of Transportation sent a letter to the Minister of Finance informing that project preparation for infrastructure development would be performed by the Ministry of Transportation and facilitation from PT SMI was stopped.

Until November 2017 no clari cation from the Ministry of Transportation on the continuation of project preparation was provided. To respond this situation, KPPIP facilitated the decision making process for project continuation with a meeting of KPPIP’s Implementation Team and KPPIP’s Ministers. From a ministerial meeting in October 2017 and the next meeting with Director General of Railways, nally KPPIP got confirmation that the dedicated SHIA express rail link project would be continued. However, review to the routes for project development was required to be carried out first. Another step necessary to resume the project was to improve its Pre-Feasibility Study.

Kuala Tanjung International Hub Port (PHI)

As a follow-up action to the Committee Meeting held in June 2017, a series of meetings at technical level were organized to agree the project development scheme with a bundling scheme for port areas, port terminals and industrial estates development. During a Committee Meeting in October 2017, the discussion was more focused on the unbundling scheme, in which the project would develop port areas and the port terminal separately from the industrial estate areas. To respond to this decision, the Ministry of Industries coordinated a discussion on industrial estate area development scheme with stakeholders. As to the development of port areas and port terminals, this would be continued by PT Pelabuhan Indonesia I since the development of port areas phase I, i.e. the construction of multipurpose terminal had been commenced. This project development scheme was intended to be finalized in early Fiscal Year 2018.

West Semarang Water Supply Project

To respond the resolutions of KPPIP’s Implementation Team meeting in March 2017 discussing State Budget – based funding scheme compared to the PPP scheme for West Semarang SPAM Project, KPPIP initiated a discussion to compare funding schemes with the Directorate of Water Supply Development, in the Ministry of Public Works and Public Housing. KPPIP urged the issuance of a letter by the Coordinating Minister for Economic Affairs to the Minister of Public Works and Public Housing No. S-55/M.

EKON/03/2017 in March2017 to reconfirm that the funding scheme for West Semarang Water Supply Project was a PPP scheme. To reply to such a letter, the Ministry of Public Works and Public Housing then issued letter No. PR.01.03-Mn/301 to Semarang Mayor informing that the scheme supported by the Government for West Semarang Water Supply Project was a PPP scheme. Thus, project preparation could be resumed with the adoption of a PPP scheme.

Jakarta Sewerage System

To continue the study that commenced at the end of 2016, KPPIP with the assistance of Indonesia Infrastructure Initiative (InDII) completed a scoping study to identify Jakarta Sewerage System (JSS) potential for further development under a PPP scheme. Based on this study, it was identi ed that JSS Zone 5 and Zone 8 have potential to prepare for a PPP scheme. To follow this identi cation, KPPIP together with DKI Jakarta Province government and Asia Development Bank (ADB) agreed that JSS Zone 8 would receive support for project preparation under a PPP scheme by Asian Infrastructure Center of Excellence (AICOE), ADB. In September 2017, KPPIP sent an official support request through the Chairman of KPPIP’s Implementation Team with letter No. S-85/D.VI.M.EKON. KPPIP/09/2017 regarding “Request for Project Development Assistance for Jakarta Sewerage System Zone 8”. Until end of 2017, KPPIP communicated with AICEO to discuss the follow-up actions of such request and the process for PPP scheme study and transaction preparation for JSS Zone 8 project.

Serang – Panimbang Toll Road

In January 2017, the consortium of PT Wijaya Karya Tbk., PT Pembangunan Perumahan Tbk., and PT Jababeka Infrastruktur was determined as successful bidder for the Serang-Panimbang Toll Road concession. This project will be developed under Supported Build Operate Transfer (SBOT) with construction support from the Government for some of the toll road segments. However, in a later development, SBOT scheme was unable to be implemented on the grounds of budget e ciency. BPJT coordinated the Ministry of Finance to revise this scheme into an Availability Payment (AP) mechanism. In July 2017, the Ministry of Finance with letter No. S-17/MK.8/2017 approved the revision of the Government’s feasibility support into AP.

With an AP scheme as Government’s support to enhance the feasibility of Serang-Panimbang Toll Road Project with the construction of 33 km toll road segment (Cileles- Panimbang section), KPPIP provided support with analysis and recommendations for the implementation of the Government’s support. In the analysis, KPPIP underlined that the implementation of AP scheme would bring about direct impact of new BUJT holding concession for Cileles-Panimbang section. For the new BUJT, its shareholders could be the consortium PT Wijaya Karya Serang-Panimbang (PT WKSP) with capital/share participation portion equal to PT WKSP (condition 1) or otherwise the new BUJP could have different shareholders (condition 2). From these two conditions, it emerged that there were some issues that should receive attention to assure sound and efficient implementation of Government’s support through AP scheme.

As to condition 1, KPPIP noted the possibility of smaller NPV of Government’s support consisting of AP to PT WKSP than support of Viability Gap Fund because of the double taxation effect. This effect occurs because the revenue earned by the new BUJT from the Government’s AP support is taxable and this will affect AP value of BUJT to the shareholders of new BUJT in the form of dividends, which are again taxable. To prevent this, recalculation was necessary so that support in AP would not decrease BUJT’s investment rate of return.

In condition 2, an issue that needed to be considered concerned the quality of construction and maintenance of toll road developed by new BUJT that must be consistent with PT WKSP’s expectation to ascertain smooth toll road operation.

Irrespective of condition 1 and condition 2, other issues that were identified as cause for concern were:

- Legality of revenue from users of toll road section receiving Government’s support by PT WKSP since such revenue would constitute non-tax revenue. In the offered schemes, all toll revenues will be recognized by PT WKSP;

- The need to construct toll gates at the ends of Cileles-Panimbang section in a separate way and that toll revenue from this section should not be mixed with overall toll road revenue.

Based on the above analysis, in view of some factors with potential to decrease the feasibility of PT WKSP from the original PPJT, KPPIP recommended compensation for PT WSKP that could consist of revisions to the concession period, initial tariff or other mechanisms. In addition, KPPIP also recommended the preparation of legal opinion for the recognition of toll road revenue earned from the Cileles-Panimbang section by PT WKSP that should be recognized as non- tax revenue. For the harmonization of toll road construction and maintenance quality between PT WKSP and the new BUTP, this can be set out in an agreement or other business-to-business agreement.

Tangerang Waste-to-Energy Project (PLTSa Kota Tangerang)

The Waste-to-Energy Project for Tangerang Municipality (PLTSa Kota Tangerang) is intended to process solid waste at TPA (Final Disposal Site) Rawa Kucing of Tangerang Municipality into electrical power. At present, TPA Rawa Kucing has to accommodate garbage not less than 1,400 ton per day using sanitary landfill. It is projected that this final disposal site will reach its design capacity (garbage collection capacity) in 2029, which unless managed properly will cause uncontrollable trash accumulation. In light of that, it is proposed to process garbage in TPA Rawa Kucing into electrical power.

From 2010 to early 2017, a Pre-Feasibility Study has been prepared by local consultants. According to resolutions of KPPIP’s Committee Meeting on 21 June 2017, PLTSa Kota Tangerang was selected as a Priority Project. KPPIP gave support for review and revision to Pre-Feasibility Study of PLTSa Kota Tangerang in August 2017. Based on such review, the proposed funding scheme was that of a PPP scheme. Tangerang Municipality stated that they could only afford to allocate budget for the processing fee at IDR100,000/ton. Thus, support from the Government and private sectors to realize this PLTSa Kota Tangerang was necessary. In September 2017, the Coordinating Minister for Economic Affairs sent a letter to the Minister of Finance regarding a request for a Project Development Facility (PDF) for PPP-based PLTSa Tangerang to accelerate its preparation so that the speci ed project milestones could be achieved.

In November 2017, the Minister of Energy and Mineral Resources sent a letter to the President Director of PT PLN to assign PT PLN as the developer of PLTSa Kota Tangerang project. As a response to this letter, KPPIP conducted a legal and nancial review, which found that authority for solid waste management lay with local government, not the central Government, and with the committed processing fee at IDR100,000/ton a bank loan with interest rate less than 5% would be necessary.

Based on these review results, KPPIP recommended continuing PLTSa Kota Tangerang Project with the adoption of a PPP scheme. Tangerang Municipality Government argued that if PT PLN scheme assignment was not in compliance with the applicable laws and regulations, then they would accept the introduction of a PPP scheme instead.

Downstream Industry Development of Oil and Gas Upstream Projects

One issue encountered by oil and gas upstream projects, which are now registered as Priority Projects, is that there is no allocation of the gas produced by their fields to downstream users. Oil and gas upstream projects such as Tangguh Train-3, Jambaran Tiung-Biru and Masela requires oil and gas downstream industries ready to receive the gas to be developed. In addition to providing fuel for the electricity sector, the gas industry plays leading roles in and generates positive multiplier effects for petrochemical industries in Indonesia.

The Ministry of Industries, which is responsible for petrochemical industry development decided that projects benefiting the downstream sector of the gas industry should be more focused on the Industrial Estate at Bay of Bintuni, which was also included in the National Strategic Project list and would consume part of gas from Tangguh Train-3 project as raw material.

Plants in the Industrial Estate of Bay of Bintuni are expected to produce methanol as a substitute component that can be maximized to produce fuel oils such as petroleum and LPG. This industry will play leading role in bolstering the national energy resilience of Indonesia.

Since October 2017, KPPIP has coordinated with the Ministry of Industries in a series of FGD sessions to discuss the most suitable funding scheme for the development of this industry. During these FGD sessions, KPPIP presented funding schemes with potential to for this industry, especially SOEs Assignment scheme and PPP schemes, and suggested that these should be implemented in the project preparation stages, for example during the nomination of Contracting Agency and OBC preparation.

During coordination sessions, other Ministries/Agencies (K/L) such as the Ministry of Finance and the Ministry of PPN/Bappenas were invited to present more clarification on funding schemes.

Based on coordination and the discussion above, the Ministry of Industries decided to adopt a PPP scheme for the development of Industrial Estates in the Bay of Bintuni. The Ministry of Industries would play a role as Contracting Agency for the project.

C. Project Monitoring and Debottlenecking

The Impacts of Agreement on Relocation Permit and SUTT/SUTER Line Elevation to the Routes of Light Rail Transit (LRT) Jakarta, Bogor, Depok and Bekasi (Jabodebek)

While construction of the LRT Jabodebek project development was started in 2016, some problems remained which required intensive coordination between stakeholders. One problem that needed immediate attention related to the decision making process for relocation permits related to the elevation of SUTT/ SUTET Line tower foundation affected by LRT Jabodebek project. Two main locations were identified as requiring permits from the related agencies, i.e. Cawang City Park Area and Road Reserve Strips (RUMIJA) of Jakarta- Cikampek (JAPEK) Toll Road.

At the location of Cawang City Park Area, the existing SUTT tower foundation of PT PLN built was over land under State Asset (BMN) status of the Ministry of Public Works and Public Housing, and needed to be relocated. The use of this land under BMN status needed agreement among stakeholders before PT PLN issues Principle Permit for the relocation of the existing tower foundation.

To respond to this issue, KPPIP facilitated a series of coordination meetings between the Ministry of Finance, the Ministry of Public Works and Public Housing, the Ministry of Transportation, Finance and Development Supervisory Body (BPKP), PT PLN and PT Adhi Karya. As a result of these meetings, it was agreed to use such BMN land for the construction of new tower foundation in lieu of tower foundation affected by LRT Jabodebek project without impairing the rights of PT PLN over the newly developed asset. In addition, the construction of new tower foundation could be commenced only if the process of transferring BMN land and the associated rights proceeded well without hampering the LRT Jabodebek project development schedule.

Meanwhile, for the location along Road Reserve Strips (RUMIJA) of JAPEK Toll Road, tower foundation of the existing SUTT/SUTET lines of PT PLN, which are in close proximity with LRT Jabodebek project site, JAPEK Toll Road Elevated II and Jakarta – Bandung High-Speed Railway must be elevated. Agreement on the height of tower foundation acceptable by these three projects must be therefore reached. However, since Detailed Engineering Design (DED) for Jakarta-Bandung High- Speed Railway Project was not yet available, the required height to elevate the existing tower foundation was not identi ed, meanwhile LRT Jabodebek and JAPEK Toll Road Elevated II had already identi ed the heights of elevation they required. Consequently, the discussion on tower foundation elevation suffered deadlock.

To solve this problem, KPPIP facilitated coordinating meetings between the Ministry of Public Works and Public Housing, the Ministry of Transportation, PT PLN, PT Waskita Karya, PT Kereta Api Cepat Indonesia Cina and PT Adhi Karya to reach agreement on the elevation of tower foundation. Since the development schedules for LRT Jabodebek project and JAPEK Toll Road Elevated II project had been prepared and their DEDs were already available, they should be able to decide the elevation of tower foundation according to their needs. Thus, it was agreed to rst accommodate the needs of these two projects.

The Signing of Loan Agreement for the Port of Patimban

In early 2017, KPPIP attempted to accelerate the issuance of an Environment Permit, which was an administrative pre-requisite for a foreign loan to the Government of Japan through JICA. The loan would be used to finance phase 1 construction of the project, which was slated for early 2018. Apart from ensuring the issuance of the Environmental Permit, KPPIP also provided assistance of inter-ministerial/agency coordination during the disbursement process of the foreign loan, particularly to the Ministry of Transportation, in the capacity of Contracting Agency, to accelerate Loan Agreement preparation stages by the Governments of Indonesia and Japan, i.e. from project inclusion phase into Green Book to Exchange of Notes. As a result, this foreign loan was able to be disbursed at the signing of the Loan Agreement on 15 November 2017.

Decision Making for Financing Portion of MRT Jakarta North – South Corridor

MRT Jakarta project for North – South Corridor is financed through State and Local Budgets, plus a foreign loan from O cial Development Assistance (ODA). The loan is aimed to nance the construction of Phase II and additional Phase I of MRT Jakarta South – North Corridor of USD1,869 million had been indicated in Green Book published by the Minister of PPN/Bappenas on 14 July 2017. On 25 August 2017, the provincial parliament (DPRD) of DKI Jakarta province approved the request by the DKI Jakarta Governor for the financing of MRT Jakarta project construction Phase II and Additional Phase I.

For project funding with State and Local Budgets, it is necessary to set the financing portions to be borne by the Central Government (State Budget) and DKI Jakarta province government (Local Budget). On 17 July 2017, the Minister of Finance sent a letter to the Coordinating Minister for Economic Affairs proposing a meeting to discussthe nancingportionsthroughtheKPPIPforum. This initiative followed a previous pattern that had been taken and because MRT Jakarta South – North Corridor project is a National Strategic Project and Priority Project. KPPIP facilitated the decision making process for this issue by organizing KPPIP’s Implementation Team Meeting and KPPIP’s Ministerial Meeting. KPPIP also analyzed the loan documents, minutes of previous meetings discussing the same issue and the impacts on the project development timeline for every alternative decision. The results of the analysis were then used as input and consideration in decision making during KPPIP Meetings.

As a result of these inputs, during KPPIP’s Ministerial Meeting in October 2017 it was decided that the nancing portions for the construction of Phase II and Additional Phase I of MRT Jakarta South – North Corridor between the Government (State Budget) and DKI Jakarta Province government (Local Budget) should be set at 49% and 51% respectively. This decision was followed by the issuance of a Regulation of the Coordinating Minister for Economic Affairs to accommodate the decision.

The Establishment of a Working Team for Transit Oriented Development (TOD) Kampung Bandan for MRT Jakarta North – South Corridor

KPPIP coordinated a meeting of stakeholders to discuss the MRT Jakarta Depot development plan. This depot is planned to integrate the TOD Kampung Bandan development. One focus of TOD is to develop public low-cost housing. Another issue relates to land use in Kampung Bandan areas.

To address this issue, KPPIP coordinated discussion and carried out analysis on the status of land in Kampung Bandan and other issues relating to land acquisition for the MRT Jakarta Depot development and TOD. To support the formulation of an action plan on this issue, KPPIP collected data relating to the land status of Kampung Bandan (HPL and HGB) from PT KAI and the Regional O ce of BPN (National Land Agency), DKI Jakarta, especially for areas in which the MRT Jakarta depot was to be constructed. Based on land status data on Kampung Bandan from PT KAI and the Regional Office of BPN, DKI Jakarta, issues relating to lands were analysed and an action plan to settle the potential problems was identified and prepared. Following a series of discussions in coordinating meetings, an action plan was approved for the establishment of TOD Kampung Bandan Working Team. The team, which is responsible for TOD Kampung Bandan development, is also tasked with handling land acquisition problems in Kampung Bandan.

As prescribed in Presidential Regulation No. 75 of 2014 jo Presidential Regulation No. 122 of 2016 the Coordinating Minister of Economic Affairs in the capacity of KPPIP Chairman is empowered to set up sector and cross-sector working teams as deemed necessary.

Some of the working teams that have been established are a Working Team for Electricity Sector and a Working Team for Bontang Oil Re nery Construction Acceleration. During KPPIP’s Ministerial Meeting in October 2017, it was agreed to set up a Working Team. In addition to resolving land-related problems, this Working Team will play roles as TOD Coordinating Committee tasked to synchronize TOD Master Plan with MRT Jakarta Depot and Public Low-Cost Housing development plan with participation of various stakeholders of the Government,

Local Government and Business Entities. To follow after KPPIP’s Ministerial Meeting in October 2017, a Decision of the Coordinating Minister for Economic Affairs was issued for the formation of this Working Team.

Acceleration of Approval Process for Natural Preservation Cooperation of Areas along Balikpapan – Samarinda Toll Road Route

In view of topographic conditions which consist of valleys and hills, in April 2017 PT Jasamarga Balikpapan Samarinda (PT JBS) proposed additional ROW for Tahura Bukit Soeharto location to the Minister of Environment and Forestry (LHK) and the Governor of East Kalimantan province. PT JBS has prepared all document requirements as established in Article 26 Regulation of the Minister of Environment and Forestry No. 85 of 2014.

In 30 August 2017, since there had been no significant progress following the request, KPPIP checked directly the status of the letter sent to the Minister of Environment and Forestry (LHK). In addition, KPPIP also coordinated with the Presidential Staff Office to urge the Ministry of Environment and Forestry to expedite the approval process for the proposed additional ROW.

To achieve such approval, KPPIP discussed this issue during KPPIP’s Implementation Team Meeting on 2 October 2017 and at the Coordinating Meeting to speed up the settlement of problems which had emerged for the Balikpapan-Samarinda Toll Road development. The meetings invited various stakeholders and discussed each meeting agenda item in detail including the corresponding solutions.

However, despite the two meetings, KPPIP still felt that no significant progress had been achieved, particularly with regard to approval process of the proposed additional ROW. So KPPIP brought this issue to the attention of KPPIP’s Ministerial Meeting held on 30 October 2017 to assure the commitment of the Ministry of Environment and Forestry (LHK) in accelerating the approval process for addition ROW at Tahura Bukit Soeharto location. During the meeting, the Ministry of Environment and Forestry (LHK) agreed to grant approval for additional ROW at Tahura Bukit Soeharto location in 2 weeks.

This agreement was expressed in a letter of the Coordinating Minister for Economic Affairs sent to the Minister of Environment and Forestry. On 3 November 2017, the Ministry of Environment and Forestry issued Letter No. S.627/KSDAE/PIKA/KSA.0/11/2017 concerning Approval for Cooperation Agreement of Additional ROW in Tahura Bukit Soeharto Location for Balikpapan-Samarinda Toll Road development.

Apart from this issue, according to the meeting held on 10 October 2017 there was still controversy on legal opinions expressed by the Prosecution Office, the Governor of East Kalimantan and Director General of Land Acquisition arguing that land acquisition at Land for Other Use areas in Bukit Tahura could be carried out according to Presidential Regulation No. 71 of 2012. Meanwhile, BPKP of East Kalimantan province opined that the land acquisition must follow Presidential Regulation No. 51 of 2017 concerning Mitigation of Land Acquisition Social Impacts Resulting from National Strategic Project Development.

To address this issue, on 23 October 2017 a discussion was held between the Chairman of KPPIP’s Implementation Team, the Director General of Land Acquisition, the Head of BPJT, and the Deputy for Government Agency Supervision of Economic and Maritime Affairs of BPKP. During the discussion, it was agreed that land acquisition in the areas in question would be carried out pursuant to President Regulation No. 71 of 2012.

Land Acquisition for Manado – Bitung Toll Road

KPPIP at all times actively conducts monitoring and debottlenecking of land acquisition and construction activities of Manado – Bitung Toll Road development. The main issue during the land acquisition process for this toll road is a relatively slow consignment mechanism. Moreover, the majority of owners whose lands are affected by the project rejected the compensation values. The compensation set by independent appraiser was deemed too low. After evaluation and re-appraisal, higher compensation was offered and most of the affected land owners agreed the values.

To cope with these various problems, KPPIP coordinated with many parties, including at the Coordinating Meeting of Manado – Bitung Toll Road held on 22 August 2017. The meeting discussed several issues arising in the field, especially relating to land acquisition. The fact that the Head of Regional Office of Land Affairs of North Sulawesi Province, who was about to retire per 1 September 2017, was also considered. KPPIP assisted in urging the Ministry of Agrarian and Spatial Planning to prepare the successor and to immediately start the transition process to ensure uninterrupted and well-advanced land acquisition process.

The protracted and lengthy land acquisition process under the consignment mechanism, which took longer than the schedule prescribed in laws and regulations was the subject of many complaints. The mechanism was identified as hampering the progress of land acquisition process. To expedite the consignment mechanism, KPPIP and the Presidential Staff Office urged the Supreme Court to take measures that could accelerate the consignment mechanism. Actions include the sending of a letter of the Coordinating Minister for Economic Affairs to the Chairman of Supreme Court dated 31 August 2017 concerning the Request for the Acceleration of the Consignment Mechanism in Land Acquisition for the development of National Strategic Infrastructure (PSN) and Priority Infrastructure Projects for public interests.

Acceleration of Jakarta Sewerage System Zone 1 Engineering Service

The first priority of Jakarta Sewerage System (JSS) was given to Zone 1 and 6 financed under foreign loans from Japan. The groundbreaking of these two priority zones was targeted to realize no later than 2018. Debottlenecking for JSS project has been focused on the acceleration of loan proposal and disbursement, and the proceeds will be used to nance JSS construction.

The loan for Zone 1 development will be divided into two packages, i.e. for engineering service and construction. The loan for Zone 6 development is planned to consist of a single loan package with a design and build concept

for the Waste Water Treatment Plan (WWTP).?For JSS Zone 1, the procurement process for Engineering Service was accomplished in 2017. The work has been commenced by a consortium of Yochiyo Engineering and several local engineering consulting firms. This consortium has accomplished the preliminary stage of technical engineering such as technical aspects relating to the options of adopting an interceptor system, separate system or hybrid system while taking construction costs and operation and maintenance costs in account.

Acceleration of West Semarang Water Supply Project Development Facility

West Semarang Drinking Water Supply Project is a drinking water supply project with potential capacity of reaching 1,050 liter per second to serve 80,000 households in three districts of Semarang Municipality, i.e. West Semarang District, Tugu District, and Ngaliyan District. This project is planned as a pilot drinking water supply project at municipality level under the PPP scheme in Indonesia. The project is currently entering its tender preparation stage.

Tender preparation for PPP – based West Semarang drinking water supply Project has been performed with a project development facility of the Directorate of PDPPI, the Ministry of Finance through the assignment of PT SMI. The Directorate of PDPPI and PT SMI launched kick-off meetings for transaction advocacy together with engineering, nancial and legal consultants that will assist until the completion of Financial Close.

The selected engineering consultant is PT IIF which was engaged in the previous PPP-based West Semarang SPAM project in 2014. The selected engineering and legal consultants are PT SMEC Denka and law firm AYMP Law.

The Government Contracting Agency for Jatiluhur Drinking Water Supply Project

Jatiluhur Drinking Water Supply Project is a drinking water supply project utilizing water from Jatiluhur dam for water treatment, transmission and distribution to West Java province and DKI Jakarta province with a capacity of 5,000 liter per second. It has been agreed that Jatiluhur Drinking Water Supply project will be executed under a PPP scheme, for which a joint venture of the related Regionally Owned Enterprise and State Owned Enterprise (ROE and SOE) will act as unsolicited bidders. The project is presently under pre-feasibility study document preparation stage by unsolicited bidders.

A problem impeding Jatiluhur Drinking Water Supply project is the absence of a strong basis for the assignment of Perum Jasa Tirta as Contracting Agency (PJPK) for Jatiluhur Drinking Water Supply project. It was therefore necessary to conduct legal review. The legal review concluded that the most suitable agency to act as Contracting Agency was the State Owned Enterprise (SOE) engaged in drinking water. This conclusion is more compelling since the project will involve several provinces.

The absence of an SOE focusing on drinking water management makes Perum Jasa Tirta II the strongest candidate for Contracting Agency. Perum Jasa Tirta is therefore now recorded as Jatiluhur Dam Management Authority. In formal terms, Perum Jasa Tirta II has been assigned as Contracting Agency for Jatiluhur Drinking Water Supply Project under Ministerial Decision No. 561/KPTS/M/2017 concerning the Assignment of President Director of PJT II as the Contracting Agency for PPP-based Jatiluhur Drinking Water Supply Project.

The Issuance of Discretional Permit for Central West Java Transmission Line 500 kV Project Location by the Minister of Agrarian and Spatial Planning

In April 2017, KPPIP in association with the Vice President Secretariat Office held a coordinating meeting with stakeholders to discuss land acquisition- related problems encountered by Central West Java Transmission Line 500 kV. One issue discussed during the meeting concerned Location Permits in ve regencies that have been extended and are now expiring. Pursuant to Law No. 2 of 2012 concerning Land Procurement for Development for Public Interests, Location Permits can be only extended once.

Based on minutes of the meeting, KPPIP urged the issuance of Letter No. S-42/D.III.MEKON/05/2017 concerning Follow-Up Action Request for Location Permit Extension by Deputy of Energy, Natural Resources and Environmental Management Coordination, the Coordinating Minister for Economic Affairs to Director General of Land Procurement, the Ministry of Agrarian and Spatial Planning. The issuance of this letter was to ask the Ministry of Agrarian and Spatial Planning to give recommendation/dispensation to the Governor of Central Java Province, which was beyond the provisions set forth in Law No. 2 of 2012 and Presidential Regulation

No. 71 of 2012. In July 2017, with support from KPPIP, the Vice President Secretariat, the Ministry of Agrarian and Spatial Planning and PT PLN, the Minister of Agrarian and Spatial Planning issued Letter No. 2567/29.1/VII/2017 concerning Dispensation/ Recommendation of Land Procurement for SUTET 500 kV PTLU Tanjung Jati – Tx (Ungaran – Pedan) Routes for the Governor of Central Java province. The letter certi ed that the Minister of Agrarian and Spatial Planning gave dispensation/recommendation for Location Renewal for another 2 years to the Governor of Central Java province in five regencies, namely Pati Regency, Kudus Regency, Grobogan Regency, Demak Regency and Semarang Regency.

To date, KPPIP together with Vice President Secretariat Office has monitored and supervised land procurement activities for the Central West Java Transmission Line 500 kV Project. In November 2017, land acquisition for Tanjung Jati – Tx section, Tx – Mandirancan section and Mandirancan – Cibatu Baru section had reached 67%. For the construction of tower foundation, the progress was 3.5% or 48 of a total of 1,386 tower sites.

Spatial Plan and Land Acquisition for Sumatra Transmission Lines

In 2017, the Sumatra 500 kV Transmission project resumed its land procurement process and the construction of tower foundations. To accelerate the development of this project, KPPIP gave debottlenecking support for problems found in the land acquisition process. The obstacles were, inter alia,: 1) the acquisition of lands controlled by private and government agencies and 2) need of monitoring to the enactment of Regional Regulation on Spatial for Riau Province.

In 2017, KPPIP held coordinating meetings with stakeholders to reach consensus on a follow-up action plan to deal with the acquisition process for the lands controlled by private and government agencies. According to the meeting, PT Waskita Karya and PT Agrowiyana would coordinate with Credit Suisse Singapore to lend land certificates. For the lands controlled by government agencies, the stakeholders agreed the utilization of their land for Sumatra 500 kV Transmission Project. While waiting for discussion between PT PLN, PT Waskita Karya and the related government agencies concerning which scheme to be applied in land acquisition process, KPPIP recommended PT PLN and PT Waksita Karya to propose a Preceding Permit (Izin Mendahului) to the competent government agencies so as to proceed with the construction process.

KPPIP conducted intensive monitoring on the issuance of the Draft Regional Regulation (RaPerda) on Riau Regional Spatial Plan. In September 2017, the RaPerda of Riau Regional Spatial Plan was approved by Riau Provincial Parliament (DPRD). As a follow-up action, in October 2017, an evaluation meeting was organized with the Ministry of Home Affairs suggesting the need for a technical meeting to accommodate the proposed power plant location in RUPTL 2017-2026, which is not included in the RaPerda of Riau Regional Spatial Plan.

In October 2017, the Minister of Environment and Forestry sent a letter to the Minister of Home Affairs asking for the rejection of the RaPerda of Riau Regional Spatial Plan since a Strategic Environmental Review for the changing use and function of forest areas was still needed. To settle this issue, it is proposed to hold a Limited Meeting chaired by the President.

Central Java Power Plant (CJPP)/PLTU Batang Construction

After reaching nancial close in 2016, PLTU Batang is in construction stage and under KPPIP monitoring. In October 2017, KPPIP and PT PLN conducted discussions on development schedules of GITET 500 kV Batang, GI 150 kV and SUTT 150 kV Batang by PT PLN. However, this activity was not yet included in the existing EIA. The license held today is that of Environmental Permit by PT Bhimasena Power Indonesia (PT BPI).

In October 2017, KPPIP organized a coordinating meeting to discuss the acceleration of permit processing necessary for GITET 500/150 kV and SUTT 150 kV development of PLTU Batang project. The meeting agreed that PT PLN and EIA Consultants would coordinate from the beginning with Central Java Environment Agency and furnish an EIA Addendum Document by end of November 2017. Thereafter, due to the additional scope of work for GITET, GI and SUTT development of PLTU Batang by PT PLN, amendment to Power Purchase Agreement (PPA) became necessary. PT PLN UIP Central Java II was expected to submit a letter to Central Java Construction Division with copy sent to Head of IPP PLN Unit to process PPA Amendment with PT BPI. PT BPI promised that they would transfer the construction area to PT PLN in January 2018.

After bilateral discussion between PT PLN and PT BPI, it has been decided that PT PLN will develop GITET, GI and SUTT Batang after PT BPI nishes the construction works and therefore that no PPA Amendment is necessary. PT BPI stated that PT PLN was considering constructing GITET 500/150 kV and SUTT 150 kV after PT BPI completed the construction. KPPIP will coordinate again with PT PLN and PT BPI to get their mutual consensus on GITET 500/150 kV and SUTT 150 kV development schedules.

Debottlenecking to Reach Financial Close of IPP Power Generation Plant with Total Capacity 7,810 MW

To expedite 35,000 KW Power Program, KPPIP has conducted monitoring and debottlenecking of IPP power plants holding PPA agreement to reach financial close. From 2016 to December 2017, KPPIP assisted IPP power plants to achieve their nancial close with a total capacity of 7,810 MW. In 2017 itself, KPPIP has assisted 13 IPP power plants to reach their financial close with a total capacity of 5,810 MW.

Three IPP power plants with total capacity 2,135 MW still have land acquisition problems and another four IPP power plants with total capacity 2,270 MW have had their progress disrupted because of no final power selling price. KPPIP gave specific support on land procurement and coordination to speed up approval nalization for the proposed foreign commercial loan. Based on KPPIP’s Committee Meeting on 21 June 2017, PT PLN expressed its commitment to settle the problems faced by five IPP powerplants, which remained obstructed by power selling price finalization and PPA amendment until August 2017.

As a follow-up action, KPPIP prepared a chronology report for every IPP power plant and organized coordinating meetings with Director General of Electricity, the Ministry of Energy and Mineral Resources and Board of Directors PT PLN in July 2017 to reach agreement on follow-up action plans. In October 2017, PPA agreement for Steam Power Plant (PLTU) Mulut Tambang Sumsel-8 (2×660 MW) was signed with revision of COD target realization shortened to 2021 for Unit-I and 2022 for Unit-II and the adoption of super- critical technology. In addition, in November 2017, PLTU Rantau Dedap (86 MW) reached agreement on price and financial close. For three other IPP power plants, based on Letter of the Minister of Energy and Mineral Resources and directives of President in August 2017, it is expected that negotiation process of power selling price will be resumed with PT PLN. Today, no agreement on power price has been achieved but remains in negotiation process.

KPPIP also provided debottlenecking support to PLTU Cirebon Expansion (1×1,000 MW). This project had a legal problem, relating to its Environmental Permit being revoced resulting from a weak Spatial Planning Recommendation by BKPRN. In May 2017, the Minister of Agrarian and Spatial Planning issued a Recommendation of Land Use for PLTU Cirebon Expansion. To support the realization of financial close, KPPIP urged the issuance of a GOI Support Letter from the Secretary of Coordinating Minister for Economic Affairs to JBIC, which was released in October 2017. KPPIP also coordinated with the Ministry of Finance and PT PLN to issue GOI Consent Letter. Thanks to this GOI Consent Letter by the Ministry of Finance, the financial close of PLTU Cirebon Expansion was reached in November 2017.

Land Procurement for Tuban Oil Refinery

With the issuance of cooperation approval (KSP) of State Asset Management (BMN) by the Minister of Finance for lands of the Ministry of Environment located in Jenu District, Tuban Regency, a consortium of Pertamina- Rosneft wished to revise the KSP scheme into a swapping mechanism. This intention was expressed in an audience request letter to the Minister of Finance, the Minister of Environment and the Presidential Staff Office. The grounds underlying this scheme revision came from Pro t Sharing Contribution clauses, which were deemed not common practice in Joint Venture schemes and obligation of providing buildings/facilities for the Ministry of Environment and the ownership status of the oil refinery after the end of KSP scheme period.

Before PT Pertamina sent such a letter, KPPIP coordinated a series of discussion involving stakeholders, which included the Ministry of Finance, the Ministry of Environment and PT Pertamina. Upon consideration of analysis by KPPIP on various State Asset (BMN) use/ transfer and inputs from other ministries/agencies, PT Pertamina decided to change the KSP pattern into a swapping scheme.

KPPIP continued giving support on coordination to further progress such scheme revision, which is still underway until to date. PT Pertamina together with the Ministry of Environment and Forestry will prepare a preliminary asset list proposed for inclusion in the Asset Swap List with the lands of the Ministry of Environment and Forestry. This asset list will be attached when PT Pertamina submits a formal request to the Ministry of Environment and Forestry regarding the revision of the asset use scheme. The Ministry of Environment and Forestry in the capacity of Asset User will send a letter requesting the revision to the use of State Lands (BMN) to the Ministry of Finance in the capacity of Asset Manager.

D. Achievements in Infrastructure Regulation Revisions

Coastal Area and Small Island Zoning Plan (RZWP3K) for Power Plant Jetties

In KPPIP’s Committee Meeting on 21 June 2017 some grave problems that had disrupted Priority Project deliveries, including spatial suitability, were discussed. A project suffering spatial issues discussed in the meeting was PLTGU Bangka Peaker, which had not yet received a Location Permit for Jetty because Regional Regulation (Perda) of Bangka Belitung Province concerning Coastal Area and Small Island Zoning Plan (RZWP3K) as the basis to issue jetty permit was not yet enacted.

From this PLTGU Bangka Peaker case, it is clear that the absence of RZWP3K at provincial level has potential to obstruct permit processes for Priority Projects and/or other National Strategic Projects (PSN) using coastal areas. In light of that, an immediate solution is necessary to ascertain uninterrupted PSN project implementation.

In addition to RZWP3K, regulation, which is closely related to the use of coastal areas is Marine Spatial Planning (RTRLN), which is currently under an harmonization process before being enacted into Government Regulation. For RTRLN preparation, KPPIP was asked by the Ministry of Marine Affairs and Fisheries (KKP) to give inputs to assure that PSN projects as well as Priority Projects would not encounter any issues relating to the use of coastal areas or the marine spatial plan.

KPPIP supported KKP in validating and preparing PSN Projects and Priority Projects quali ed for listing in the annex of Priority Projects i.e. RTRLN Government Regulation Preparation and supporting coordination with stakeholders for RTRLN preparation.

Project Legal and Structure Review and the Implications for Tipping Fees for Waste-to-Energy (PLTSa) Projects

Waste to Energy project is a National Strategic Project (PSN). One attempt taken by the Government to expedite its construction was to issue Presidential Regulation No. 18 of 2016 concerning the Acceleration of Waste-Based Power Generation Development in Seven Cities. However, this regulation was repealed under a Supreme Court decision on the grounds of: 1) Environmental Permits should not be issued during construction and 2) limitation to the scope of thermal technology application is prohibited, otherwise it may cause negative impacts on health.

KPPIP conducted problem identification and analysis of these Waste to Energy projects. The analysis revealed four issues with potential to disturb the implementation process, namely: 1) processing fee; 2) volume and type of garbage; 3) power selling price; and 4) GOI support of AP or VGF. KPPIP also identi ed efforts that could be taken by stakeholders to deal with such issues, which included: 1) Waste to Energy structure with PPP scheme as a funding mechanism option; 2) processing fee calculation form demand side to meet the demand from the supply side; 3) location selection for Waste to Energy development while taking the most economic transportation distance from all trash sources into account; 4) the selling price of power generated from Waste to Energy project, which is included in acceleration program based on Regulation of Minister of Energy and Mineral Resources ESDM No. 50 of 2017; and 5) GOI support of AP or VGF to minimize the required processing fee.

Based on coordination with PT PLN and the Ministry of Energy and Mineral Resources, it was agreed that the selling price of power produced by Waste to Energy projects included in the acceleration program would refer to Minister of Energy and Mineral Resources Regulation No. 50 of 2017 stating that the selling price of power from Waste to Energy project in acceleration program shall refer to previous regulation, i,e, Minister of Energy and Mineral Resources Regulation No. 44/2015 set at 18.77 cent/kWh.

Coordination with the local governments, for Waste to Energy Tangerang and Waste to Energy Bandung Raya projects agreed on the adoption of a PPP scheme as an attempt to reduce the necessary processing fee. For Waste to Energy projects in the other six cities, they had just reached pre-feasibility study preparation stage.

Coal Ash Management Policy for Coal Steam Power Plant (PLTU) Mulut Tambang

The increasing number of PLTU plants required to accelerate 35,000 MW Power Program has sparked problems relating to coal ash production, as its quantity exceeds the amount that can be used by industries. An attempt recommended by PT PLN is to exempt coal ash from the Hazardous Waste (B3) list for simpler procedure in benefiting coal ash without necessarily revising EIA documents.

However, the representative of the Ministry of Environment and Forestry informed that according to Regulation of the Minister of Environment No. 55 of 2015 concerning Procedures for Hazardous Waste Characteristic Testing, coal ash exemption shall be only granted to particular projects complying with speci ed requirements. Meanwhile, at present the Ministry of Environment and Forestry is preparing a Ministerial Regulation regarding Technical Requirements and Procedure for the Relocation of Hazardous Waste into Ex-Mine Areas. However, back filling can be only made if the owner of the waste and ex-mine area are parts of one entity.

In August 2017, KPPIP together with Vice President Secretariat Office held a coordination meeting with PT PLN and the Ministry of Environment and Forestry to talk about the management of y ash and bottom ash (FABA) produced from combustion residue of Coal-Fired PLTU, especially Steam Power Plant (PLTU) Mulut Tambang . This coordinating meeting was needed to reach consensus of stakeholders with regard to the management of FABA from Steam Power Plant (PLTU) Mulut Tambang. Stakeholders who attended the meeting were inclusive of Special Staff of Vice President for Infrastructure and Investment Division, Director of Hazardous Waste (B3) Management of the Ministry of Environment and Forestry, representative of Director General of Road and Bridges (Bina Marga), the Ministry of Public Works and Public Housing, PT PLN, BPKP, Junior Prosecutor for Administration Civil Division of Attorney General O ce and KPPIP. The resolutions agreed in the meeting included:

- FABA can be managed under the existing regulations;

- Exemption to Hazardous Waste (B3) Management , especially FABA can be taken in 3 alternatives: 1) maximized as by product, 2) back filling; and 3) land fill;

- FABA management through exemption must be made with request submitted by Person in Charge for FABA management;

- Back filling for FABA is possible subject to conditions:

– The mine entity is the same as the entity owning FABA or there is responsible party for back filling for 30 years, for example PT PLN or other institutions assigned to take responsibility;

– Back filling activities specified in environmental documents

– Back filling must be performed according to procedures for mine closure.

For Steam Power Plant (PLTU) Mulut Tambang development in Sumatra and Kalimantan, PT PLN has assigned PT Indonesia Power and PT Pembangkitan Jawa Bali. In August 2017, KPPIP held a coordinating meeting with PT Indonesia Power and PT Pembangkitan Jawa Bali to present the resolutions achieved in the meeting with the Ministry of Environment and Forestry concerning the management of FABA produced from Steam Power Plant (PLTU) Mulut Tambang. In the meeting, PT Indonesia Power and PT Pembangkitan Jawa Bali promised to prepare IEA documents while including back filling activities and specifying the party held responsible for such activities.

The Regulation of DKI Jakarta Governor No. 140 of 2017 concerning the Assignment of PT Mass Rapid Transit Jakarta as the Main Operator of Transit Oriented Development for North – South Corridor Phase 1

One aspect of the various main factors that should receive great concern on Mass Rapid Transit project development in Jakarta is how to allocate the required funding in a sustainable way. This funding requirement can be only reached with a viable nancial structure, which consists of farebox revenue projection, expenditure projection, non-farebox revenue projection (e.g. ads, space rental, etc.) and GOI support projection (subsidy).

Speci cally on non-farebox revenue, an opportunity that can optimize it is Transit Oriented Development (TOD). According to the Regulation of the Minister of Agrarian and Spatial Planning/Head of BPN No. 16 of 2017 concerning Transit Oriented Development (TOD) Guideline, TOD is a zone development concept inside and in the vicinity of areas dedicated for inter-mode and intra-mode exchanges so as to enhance the added value.

To become main operator for TOD management at MRT South – North Corridor in Jakarta, PT MRT Jakarta sent a letter to the Governor of DKI Jakarta asking the assignment/decision of PT MRT Jakarta as the main operator for TOD management at North – South Corridor Phase I (13 zones) and Phase II (8 zones). On 6 October 2017, the Regulation of DKI Jakarta Province No. 140 of 2017 concerning the Assignment of Limited Liability Company Mass Rapid Transit Jakarta as the Main Operator for the Management of Transit Oriented Development for North – South Corridor Phase I was enacted.

Pursuant to Article 4 such Governor Regulation, for this preliminary stage, the zones established as TOD areas for management by PT MRT Jakarta shall include Bundaran HI, Dukuh Atas, Setiabudi, Bendungan Hilir, Istora Senayan, Blok M and Lebak Bulus. As for other locations along the North – South Corridor, further review of their supporting capacity as well as their accommodating capacity are still necessary.

With this Governor Regulation, it is expected that PT MRT Jakarta will be able to develop the commercial functions of TOD areas that in turn generate added values and commercial profits as non-farebox revenue sources.

Tariff Review for Drinking Water Supply Projects

Drinking water supply projects plays a crucial role in augmenting the living standard/quality of people and in alleviating waterborne disease prevalence. According to Government Regulation No. 122 of 2015 concerning Drinking Water Supply System (SPAM), the implementation, development and management of drinking water services and infrastructure shall be performed by Regionally Owned Enterprises (ROEs) in this case Local Drinking Water Enterprises (PDAMs) established by regency or city governments.

In attempt to bolster these water enterprises, the Government has taken restructuring measures with debt write-off to make PDAMs become more solvent companies. Now, another issue needs more attention related to the implementation of water tariff setting policy.

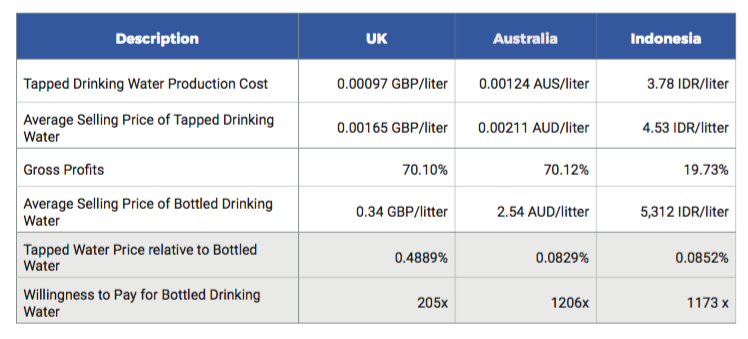

A way to review water tariff setting in Indonesia is to analyze international benchmark that has been applied in other countries such UK and Australia. KPPIP has analyzed international benchmark on drinking water tariff setting in Indonesia. The analysis is divided into two parts, i.e.:

- Calculate the ratio of tapped drinking water production costs and the selling price of bottled drinking water; and

- Analyze the ratio of international benchmarks with the conditions in Indonesia at present to get hypothetical Willingness to Pay/WRP for the applicable water tariff.

The results of international benchmark analysis by KPPIP can be seen below.

From the above analysis results, it can be concluded that:

- The gross profits from the sales of tapped drinking water in Indonesia are to reach ~ 20% on average, which is much lower than the selling price in UK and Australia where the gross pro ts are ~ 70% on average; and